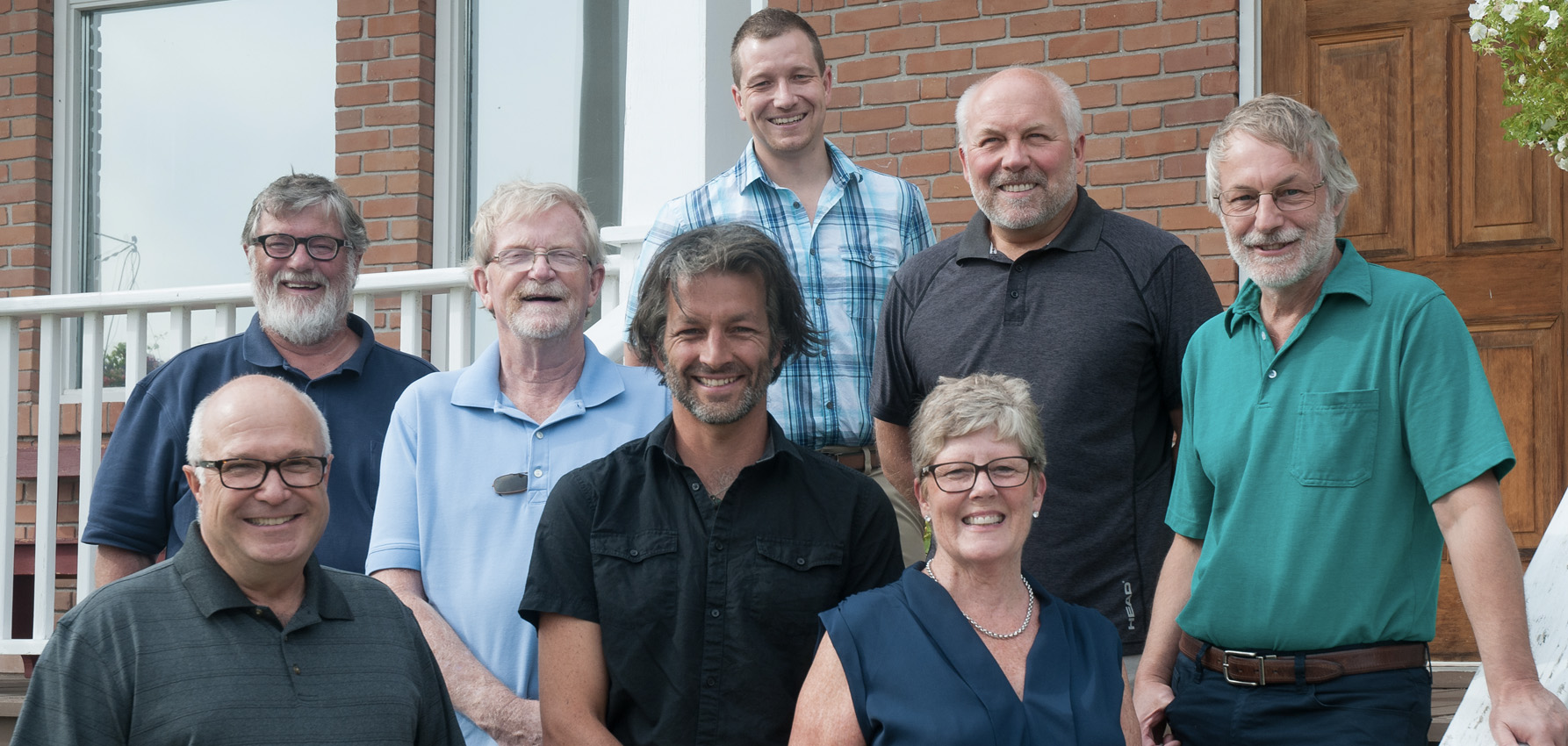

Joint Message From the Board and Management at gfcu

2019 marked seven decades of business for the Grand Forks Credit Union. What started in 1949 with a few like-minded individuals, a few dollars, and a few ideas, has since grown into an immeasurable community asset. We are excited and proud to use this report to share with you some highlights of what took place in 2019, our 70th year in operation.Notably, 2019 marked the first year for our new CEO, Becky Clements. While Becky has been with us for a number of years, it was exciting to see her step into this new role in such a seamless fashion. Working collaboratively with the Board of Directors, Becky and the entire management team worked to successfully navigate through the year of change. Notable successes include: accomplishing an above budget financial return, ongoing participation and contribution to the merger project development, and favourable internal/external audit results.

Financial performance during 2019 was excellent. The gfcu amassed a net growth of $1.97 million and closed out the year with total assets in excess of $244 million. Earnings before dividends and taxes surpassed $1 million, from which the Board approved a 6.20% distribution of patronage dividends, which came out to more than $460,000 going back to our members. Residential mortgage growth exceeded expectations at $9.7 million. Member deposits, while short of target, grew over $1 million. One area that remained challenging was the growth of our commercial loan portfolio. Outside of our local business borrowing needs, we also work with other credit unions in partnering on syndicated loan arrangements to invest our available capital and liquidity for a better return on investment.

Another highlight is the performance of our gfcu MoneyWorks wealth management subsidiary. Our local Financial Planner, John McPhee, provides personal financial planning, customized investment, as well as insurance and estate planning services. John has been recognized as a top-ranked advisor and works closely with our credit union members and employees to provide financial advice.

The local economic environment continues to experience struggles in the aftermath of the 2018 flood. Many businesses have reopened, new businesses have set up shop, and we are beginning to see a return of the vibrant downtown business scene. Some, however, continue to experience great difficulty in reopening, which creates some future uncertainty. Our team has worked personally with each of our flood-impacted members, including both businesses and individual members of the community. Because of this, we understand that each situation is different, and we’ve been working with members according to their need – there is no “one size fits all” solution for something like this. A notably different approach than that of the other local financial institutions. While there are minimal metrics to quantify this kind of outreach, knowing that our staff worked to positively support our members, during what may arguably be one of the most stressful periods in their lives, far surpasses any financial measurement.

2019 also marked our exciting foray into the world of Ultreia® Lean, which is the process of implementing a continuous improvement business strategy. Chrissy Peterson, our Small Business Account Manager, participated in an intensive training program and represented the gfcu alongside other employees from our regional partner credit unions. The group of 11 trained together to learn the principles of the Lean continuous improvement methodology, concluding with a Green Belt certification. The ultimate goal is to identify and implement process improvements (both big and small) and seek ways to do things better on a day-to-day basis. We look forward to fully engaging in these practices as we move ahead. Congratulations to Chrissy for taking this on and leading the charge as we embark on this cultural shift of discovering improvements to our business process.

In line with that collaborative effort, our Board of Directors and Management team has remained fully engaged in merger conversations with our five regional credit union partners: Columbia Valley, Kootenay Savings, Nelson and District, East Kootenay Community, and Heritage Credit Union.

Having collaborated on many projects over the years, we six partners are excited to see what we can do even better together. We see opportunities to share resources and expertise across our regions to provide enhanced service to members, while improving our long-term sustainability.

Through an in-depth due diligence process, a comprehensive business case has been built. All six Boards of Directors have considered this business case positive and worth moving to the next stage of the process – applying for consent from the provincial regulator. This stage is a very dynamic process with changing timelines; however, we are committed to keeping members updated. Lastly, but critically important is reaching the milestone of a member vote. In the end, it is you, our members, who will make the final decision on whether a merger is in the best interest of our communities, our employees and our members.

For more information and updates, visit www.exploringstrengthandunity.ca

We thank you for your continued commitment and loyalty as members. Nothing we have accomplished in the past and nothing we will accomplish in the future can be done without you. The entire gfcu team, past and present, is proud of what has been accomplished over the past seven decades and are excited by the potential of the next seven.

Michael Strukoff - Board Chair

Becky Clements - CEO